Self Managed Super Fund (SMSF) Loans

Invest in real estate and grow your retirement nest-egg with a super fund loan.

SMSF Loans

Super-leveraged property investment is an ideal way for you to grow and accelerate your retirement nest egg. There are several exceptional benefits to utilising an SMSF loan as part of your funds investment strategy

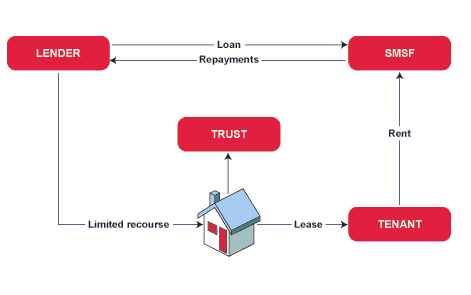

Self managed super funds (SMSFs) can borrow money for the purchase of residential or commercial investment property, with the property held in trust for the SMSF until the loan has been repaid.

If you have a self managed super fund or are considering establishing your own super fund, a properly structured self managed super fund loan will allow your fund acquire a real state asset for capital growth and return.

SMSF loans are also known as limited recourse borrowing arrangements (LRBAs). The super fund loan is a limited recourse loan which means recovery of the loan is limited to the security property, in the event of default other super fund assets are not at risk.

Serviceability of the loan can be demonstrated through rental income from the investment property as well as member contributions and ongoing income from other assets held in the self managed fund.

SMSF loans are generally supported by personal guarantee/s from the beneficiaries (members) as well as confirmation from the SMSF trustee that the loan is in line with the funds investment strategy.

Talk to one of our specialist lending managers today about how our flexible SMSF loan products could be an ideal way to reach your funds investment goals.

SMSF Loan Features

Our flexible SMSF loan product is suitable for both residential and commercial real estate and comes with flexible features and no minimum net asset requirements.

Note: All applications are subject to normal credit assessment and loan suitability criteria. Terms and conditions, fees and charges apply. Minimum loan advance is $250,000.

SMSF Loan Benefits

Here are some of the benefits of our popular SMSF loan products.

Qualifying for an SMSF Loan

How does an SMSF loan work?

How We Help Others

SMSF Loan FAQs

The SMSF chooses the property it wishes to invest in, in the ordinary way. Residential property must be purchased from an arm’s length vendor. Non residential property can be purchased for full value from related parties so long as the property is let for business purposes.

The SMSF’s lawyer/conveyancer acts on the purchase in the ordinary way. The purchase must be in the name of the bare trustee. The SMSF pays the deposit, the balance purchase money (less the amount borrowed), the legal costs, and stamp duty in the ordinary way. On completion of the purchase the bare trustee mortgages the property to the lender. SMSF then manages the asset in the same way as any other real estate investment.

Yes, the SMSF funds members are normally required to sign a certificate of independent financial & legal advice in relation to the proposed loan which is returned along with the mortgage documents.

If you are purchasing a commercial property to be occupied by a related business and leased back to the SMSF this is acceptable. However if the property is residential you cannot occupy the dwelling doing so would breach the “in-house asset rule”. However your SMSF can buy a residential property that the investor intends to live in after retirement when you transfer the property from your super fund to yourself after you retire.

That was correct, until amendments to the Superannuation Industry (Supervision) Act 1993 (SIS Act) made in September 2007. Under the new section 67 (4A) of the SIS Act, SMSFs can borrow providing the following conditions are satisfied. The borrowed funds are used to purchase an asset (e.g. real estate) The asset is held on trust for the SMSF by another entity (i.e. the bare trustee). The SMSF must have the right to acquire legal ownership of the asset by making payment.

SMSFs must ensure that the level of investment in real property is in line with your fund’s investment strategy. Although there is no prohibition on an SMSF acquiring up to 100% of the fund’s total assets in the form of real property. SMSF trustees must ensure that the fund has sufficient diversification of assets to meet the requirements of the SIS Act.

As the beneficial owner of the property and the borrower of the loan, the SMSF is responsible to pay all the usual amounts that you would expect to if you had bought an investment property and borrowed money on it in your own name rather than your super fund. For example, your SMSF will be required to pay: council rates, water rates, and land tax (if any); interest and other loan repayments; loan fees; repairs; property management costs; and any insurance premiums.

When the loan is fully repaid, the SMSF is entitled to have the legal title transferred to it. Depending on how the trust structure is set up and administered, this transfer should be possible without incurring tax, GST, or stamp duty liabilities (other than nominal). Of course, this position may change because of future changes in the law.

The bare trustee must be a separate corporate entity to the SMSF trustee. It is important that the SMSF trustee itself is not the same entity as the bare trustee because such an arrangement may breach the requirements of section 67(4A) of the SIS Act and result in the SMSF being non-compliant.

The loan approval process for an SMSF loan is similar to a standard mortgage loan. There are a few differences, essential there are ten (10) steps as follows;

- Establish your SMSF trust.

- Establish your SMSF bank account.

- Obtain conditional loan approval.

- Establish the bare trust deed and bare trustee.

- Execute your purchase contract.

- Arrange the security property valuation.

- Obtain formal loan approval.

- Solicitors will review your deeds and prepare mortgage documents.

- Return your mortgage documents and book in a settlement date.

- Settlement occurs in accordance with your purchase contact (if applicable).

SMSF Loan Articles

Looking for more information? Discover our extensive self-managed super fund resources in our information article archives.